FUNDING PRESIDENT ELECT TRUMP’S PROPOSED $1T INFRASTRUCTURE PLAN

FUNDING PRESIDENT ELECT TRUMP’S PROPOSED $1T INFRASTRUCTURE PLAN

How The Trump Administration Can Fund a $1 Trillion Government Investment in Infrastructure Without Increasing the National Debt or Causing Significant Inflation

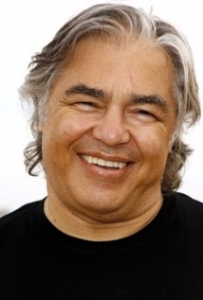

by Patrick S.J. Carmack, JD

The Trump Administration can fund its proposed $1 trillion US infrastructure rebuild without inflation or increasing the national debt, provided it is done without increasing the overall quantity of high-powered money in the money supply. There are two ways to do that: the simplest is by increasing the RRR (required reserve ratio – the proportion of bank assets held in cash or highly liquid assets); the other – more complex method – is by increasing the bank capital requirements (ratio of bank equity to debt).

Ironically, because of the size of this proposed expenditure, there exists the real possibility of indirectly introducing monetary reform in the US in approving this expenditure, provided it is done accompanied by one of the two mechanisms above, which would remove two principal objections to the proposal: that it will ultimately be highly inflationary and it will increase the national debt by $1 trillion. Such an increase in the money supply would indeed, inevitably be inflationary, unless a significant portion of these funds were “sterilized” (as has been done with most of the $4.5 trillion in “quantitative easing” Fed expenditures, with the interest cost on excess reserves held/sterilized at the Fed [presently c. $2 trillion] paid at taxpayer expense).

However, to make such an increase in government expenditures – over and above the huge current deficits – politically palatable, increasing the RRR to require increased bank reserves equal to the increased money supply caused by funding this specific program would absorb the new money without any inflationary (or deflationary) effect. This could not be done if the US already had a 100% RRR, but since our current RRR average is well below 10%, we have plenty of room to require banks to increase their reserves by the $1 trillion over ten years, thereby neutralizing the monetary expansion required for this program.

Since the US money supply (M2) is over $13 trillion (Nov., 2016), an increase in the RRR on the order of 7% (i.e., from the present 10% to 17% – this can easily be precisely calculated) would absorb the $1 trillion without any inflationary or deflationary effect. The RRR could be very gradually increased on a monthly basis (proportioned to the expenditures for the infrastructure project that month), which, if done over the proposed ten-year period, would average to less than a 1% RRR increase per year. It could also be done much more quickly – e.g., in two-four years.

Further, if this $1 trillion were introduced into the money supply as US Notes (i.e., simply not borrowed by the issuance of an equivalent amount of Treasury bonds and other securities), it would not increase the national debt. In fact, if these expenditures were made accompanied by the RRR increase suggested above, it would be important not to increase the national debt by selling Treasury bonds or securities, as this would drain the capital markets of such a sum, gradually increasing interest rates on the balance of the $20 trillion national debt, resulting in increasing interest costs on that debt, leading to higher budget deficits, and more debt. Each 1% interest rate increase would add approximately $200 billion in annual interest costs. This could only be avoided by continuing to keep the interest rates artificially low by government (Fed) interference in the capital markets, resulting in increasing bubbles in various sectors such as housing and the stock market, with inevitable price collapses in those sectors, at high social cost to the already debt-strapped American middle class, which could and probably would result in a new recession, or depression, defeating a large part of the whole purpose of the project: job creation.

Patrick S. J. Carmack

This approach then, would: balance the money/credit supply; provide the $1 trillion needed for this infrastructure project without increasing the national debt; be neither inflationary nor deflationary; and would be empirically instructive to both Congress and the American people that the current system of debt-financed US budget deficits (which the US has run 45 out of the last 50 years) is an unnecessary expense (interest on the debt is presently over $23 billion per month and rising) and needlessly transfers over 97% of the money-creation power of government and the seignorage (profit from money creation) to private banks, which is the main cause of the serious and growing income inequality in the US and internationally. 11.29.16 Copyright Reserved– Patrick S.J. Carmack, JD

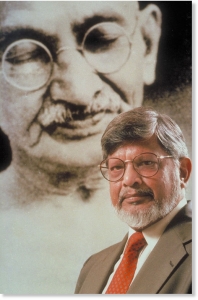

Arun Gandhi “Mr. Carmack, What you have shown in the scenario is what we are constantly doing at the personal level as well as the public level. It is the policy of exploitation that the rich employ against the poor. This is why grandfather [Mahatma Gandhi] said ‘Materialism and morality have an inverse relationship – when one increases the other decreases.’ If I may, I would like to keep the videos as resource material to teach students about economic violence in the world. With good wishes. Yours sincerely, Arun Gandhi, M.K. Gandhi Institute for Nonviolence”

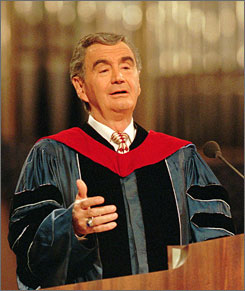

Arun Gandhi “Mr. Carmack, What you have shown in the scenario is what we are constantly doing at the personal level as well as the public level. It is the policy of exploitation that the rich employ against the poor. This is why grandfather [Mahatma Gandhi] said ‘Materialism and morality have an inverse relationship – when one increases the other decreases.’ If I may, I would like to keep the videos as resource material to teach students about economic violence in the world. With good wishes. Yours sincerely, Arun Gandhi, M.K. Gandhi Institute for Nonviolence” Milton Friedman “Mr. Carmack, As you know, I am entirely sympathetic with the objectives of your Monetary Reform Act…You deserve a great deal of credit for carrying through so thoroughly on your own conception…I am impressed by your persistence and attention to detail in your successive revisions… Best wishes. Milton Friedman,” Nobel Laureate in Economics; Senior Fellow, Hoover Institution on War, Revolution and Peace

Milton Friedman “Mr. Carmack, As you know, I am entirely sympathetic with the objectives of your Monetary Reform Act…You deserve a great deal of credit for carrying through so thoroughly on your own conception…I am impressed by your persistence and attention to detail in your successive revisions… Best wishes. Milton Friedman,” Nobel Laureate in Economics; Senior Fellow, Hoover Institution on War, Revolution and Peace

Malachi Martin “I endorse the video because people should know what is happening.” – Malachi Martin, late Professor at the Pontifical Biblical Institute and a close associate of Pope John XXIII; author of: The Windswept House; Vatican; The Keys of the Blood, and numerous other books

Malachi Martin “I endorse the video because people should know what is happening.” – Malachi Martin, late Professor at the Pontifical Biblical Institute and a close associate of Pope John XXIII; author of: The Windswept House; Vatican; The Keys of the Blood, and numerous other books Russo “I’m a big fan of The Money Masters. It’s undoubtedly the best work on the Federal Reserve. It convinced me that the only solution to our economic troubles is the Monetary Reform Act. Before that, I had no idea how to get out of this mess. Why can’t our politicians get this? In a single year America could once again be on the path to political and economic freedom. I hold your work in the highest regard and drew from it heavily for my own film.” Aaron Russo, Feb. 2007, Hollywood Producer, Director and Writer of America, Freedom to Fascism

Russo “I’m a big fan of The Money Masters. It’s undoubtedly the best work on the Federal Reserve. It convinced me that the only solution to our economic troubles is the Monetary Reform Act. Before that, I had no idea how to get out of this mess. Why can’t our politicians get this? In a single year America could once again be on the path to political and economic freedom. I hold your work in the highest regard and drew from it heavily for my own film.” Aaron Russo, Feb. 2007, Hollywood Producer, Director and Writer of America, Freedom to Fascism G Edward Griffin I appreciate and applaud your efforts to accomplish something specific in the area of monetary reform. . . I do not hesitate to recommend that people view The Money Masters for the excellent overview of fraudulent banking which it presents. . . G. Edward Griffin,” author of THE CREATURE FROM JEKYLL ISLAND; A Second Look at the Federal Reserve

G Edward Griffin I appreciate and applaud your efforts to accomplish something specific in the area of monetary reform. . . I do not hesitate to recommend that people view The Money Masters for the excellent overview of fraudulent banking which it presents. . . G. Edward Griffin,” author of THE CREATURE FROM JEKYLL ISLAND; A Second Look at the Federal Reserve W Cleon Skousen “This is undoubtedly the most comprehensive presentation of the history of our money system and who is responsible for the disastrous consequences that has left us with an unconstitutional money system and multi-trillion dollar debt.” – Dr. W. Cleon Skousen, author of The Naked Capitalist and The Naked Communist

W Cleon Skousen “This is undoubtedly the most comprehensive presentation of the history of our money system and who is responsible for the disastrous consequences that has left us with an unconstitutional money system and multi-trillion dollar debt.” – Dr. W. Cleon Skousen, author of The Naked Capitalist and The Naked Communist